It has been a while since I looked closer into PayPal (PYPL). The payment systems vendor caught my attention at first in October 2017, after the company delivered an impressive quarter that reflected strong growth momentum and improving margins.

Fast forward nearly 18 months and 46% in market value gain, I am ready to add this stock to my Storm Resistance Growth's "All-Equities SRG" portfolio.

Credit: BBC

Growth at the Core of the Investment ThesisAn investment in PayPal starts with a conviction that the company is on the right side of growth trends in the payments processing space. Consistent with my arguments on Visa (V), I believe PayPal is also positioned to benefit from a secular shift in payment methods, from cash and checks to plastic and electronic - a process that is well underway in developed countries but still growing, while incipient in many other global markets.

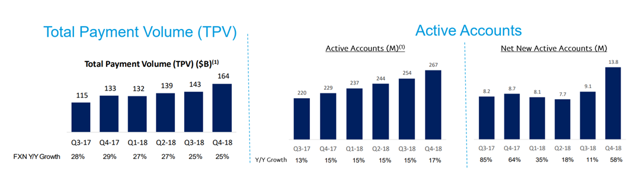

The fintech's key operating metrics look highly encouraging, as the graph below suggests. Total payment value, or TPV, growth shows little sign of slowing down, despite the drag caused by a fast-declining eBay Marketplace (NASDAQ:EBAY) business - which I expect to account for less than 10% of TPV as early as next quarter and continue to trend towards irrelevance. Meanwhile, the number of total active accounts has been growing at an accelerating pace, even after adjusting for 2.9 million net adds from acquisitions in 4Q18.

Source: Montage using graphs from PayPal's earnings slides

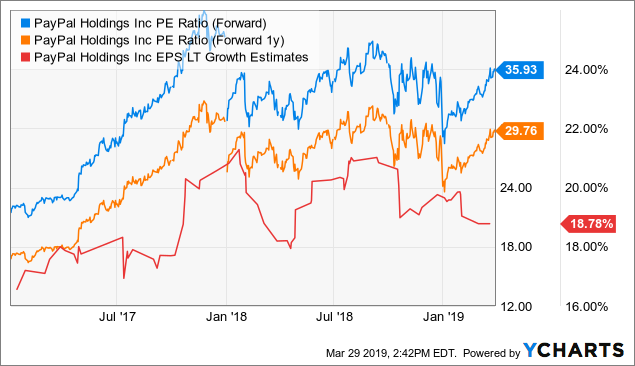

I expect PayPal to use economies of scale to its benefit and improve margins over time, which should bode well for earnings growth. Currently, EPS is forecasted to increase annually at a pace of nearly 20% in the long run (see red line below, implying a reasonable long-term PEG multiple of 1.9x). I believe that this estimate could be surpassed if margins lever up and the crucial Venmo business ($18.8 billion in TPV and growing at a dizzying pace of 80%) is able to drive an improvement in profitability that has yet to materialize.

Data by YCharts

Data by YCharts

Driving home the argument that PYPL deserves a spot in my diversified portfolio is what I call the "SRG factor", with the acronym standing for "storm-resistant growth". I have coined this phrase to describe stocks or portfolios that are able to grow consistently over time while providing some level of downside protection.

In the case of PayPal, two points need to be made here. First, two of the company's key drivers of financial performance are (1) the size of the user base and (2) the volume that they transact. As I have presented earlier, both metrics have been growing robustly and at a consistent pace.

Because PayPal does not rely on new customers "walking in the door" in order to produce sales (it already has access to a sizable potential customer pool, a.k.a. its user base), the company's financial results are likely to be less bumpy and more predictable. As a result, I expect PYPL's price to behave less erratically, after adjusting for the high growth expectations that tend to add more volatility to the stock's performance.

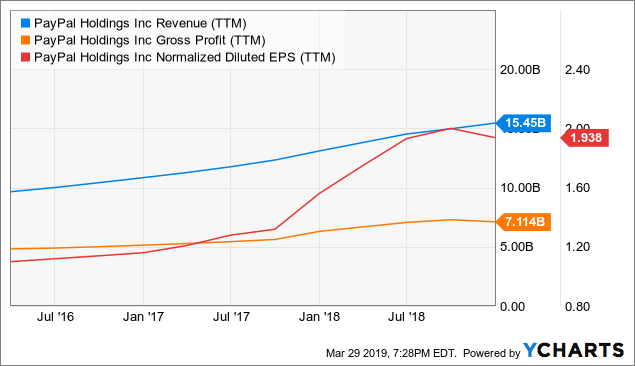

See trailing twelve-month revenue, gross profit and EPS trends over the past three years.

Data by YCharts

Data by YCharts

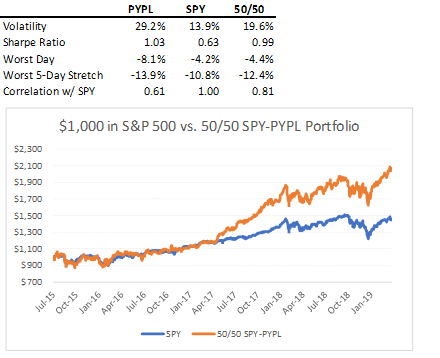

Second, and from a historical perspective, PYPL has been a strong performer in both absolute and relative-to-risk terms since the 2015 spin-off, while being only loosely tied with the behavior of the S&P 500 (SPY). The stock's daily return correlation with the equities index has been only 0.6x, while shares have shown signs of resilience even during times of broad market distress.

For example, since the start of the fourth-quarter "quasi-bear" of 2018, PYPL has moved up +19% (weathering an ill-received 4Q18 earnings report) and never dipped more than 14 percentage points. In contrast, the S&P 500 has been down -4% over the past six months, after having lost almost 20% of its market value by the Christmas holiday.

As a result of the low correlations and strong risk-adjusted returns, PYPL has been a great complement to an all-equities portfolio. A 50-50 investment equally split between the stock and the S&P 500 and rebalanced monthly since July 2015 would have returned nearly +22% per year (vs. the S&P 500's +13.9%), while experiencing a -4.4% daily drop at worst (vs. the S&P 500's -4.2%). The risk-adjusted return of the hypothetical portfolio would have been significantly better than that of the S&P 500, as the difference of 0.36 in Sharpe ratio suggests.

See table and chart below:

Source: DM Martins Research, using data from Yahoo Finance

Because of PayPal's growth prospects coupled with the stock's desirable diversification features, I am convinced that the company will be a good addition to my portfolio at current levels.

Members of my Storm-Resistant Growth community will continue to get updates on PYPL (allocation updates, insights, etc.) and the performance of my "All-Equities SRG" portfolio on a regular basis. To dig deeper into how I have built a risk-diversified strategy designed and back-tested to generate market-like returns with lower risk, join my Storm-Resistant Growth group. Take advantage of the 14-day free trial, read all the content written to date and get immediate access to the community.

Disclosure: I am/we are long V. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Park City Group, Inc., a software-as-a-service provider, designs, develops, and markets proprietary software products in the United States. The company offers ReposiTrak MarketPlace, a supplier discovery and B2B e-commerce solution that is used for sourcing products, and enables to screen and choose suppliers; ReposiTrak Compliance and Food Safety Solutions, which reduces potential regulatory and legal risk from their supply chain partners; and ReposiTrak Supply Chain Solutions, which enables customers to manage relationships with suppliers. It also provides ScoreTracker, Vendor Managed Inventory, Store Level Ordering and Replenishment, Enterprise Supply Chain Planning, Fresh Market Manager, and ActionManager supply chain solutions. In addition, it provides business-consulting services to suppliers and retailers in the grocery, convenience store, and specialty retail industries, as well as professional consulting services. The company primarily serves multi-store retail chains, wholesalers and distributors, and suppliers. Park City Group, Inc. was founded in 1990 and is headquartered in Salt Lake City, Utah.

Park City Group, Inc., a software-as-a-service provider, designs, develops, and markets proprietary software products in the United States. The company offers ReposiTrak MarketPlace, a supplier discovery and B2B e-commerce solution that is used for sourcing products, and enables to screen and choose suppliers; ReposiTrak Compliance and Food Safety Solutions, which reduces potential regulatory and legal risk from their supply chain partners; and ReposiTrak Supply Chain Solutions, which enables customers to manage relationships with suppliers. It also provides ScoreTracker, Vendor Managed Inventory, Store Level Ordering and Replenishment, Enterprise Supply Chain Planning, Fresh Market Manager, and ActionManager supply chain solutions. In addition, it provides business-consulting services to suppliers and retailers in the grocery, convenience store, and specialty retail industries, as well as professional consulting services. The company primarily serves multi-store retail chains, wholesalers and distributors, and suppliers. Park City Group, Inc. was founded in 1990 and is headquartered in Salt Lake City, Utah. Castlight Health, Inc. provides a software-as-a-service platform used for health benefits navigation for employees in the United States. Its platform matches employees to the resources their employers make available to them; managing a condition; and assists them to manage their benefits. The company also offers communication and testing, implementation, and user customer support services. It serves customers in a range of industries, including education, manufacturing, retail, technology, and government. The company was formerly known as Ventana Health Services and changed its name to Castlight Health, Inc. in April 2010. Castlight Health, Inc. was founded in 2008 and is headquartered in San Francisco, California.

Castlight Health, Inc. provides a software-as-a-service platform used for health benefits navigation for employees in the United States. Its platform matches employees to the resources their employers make available to them; managing a condition; and assists them to manage their benefits. The company also offers communication and testing, implementation, and user customer support services. It serves customers in a range of industries, including education, manufacturing, retail, technology, and government. The company was formerly known as Ventana Health Services and changed its name to Castlight Health, Inc. in April 2010. Castlight Health, Inc. was founded in 2008 and is headquartered in San Francisco, California.

system, which gives both stocks a 3.75, just a notch away from the "buy zone."

system, which gives both stocks a 3.75, just a notch away from the "buy zone."